Simplifying the Way Investors Generate Predictable Income

A patented, Institutional-grade income-planning technology designed for financial professionals and their clients.

Build Durable Spending Plans with reddi

Through a simple process and technology platform, reddi empowers advisors to develop a spending plan for clients desiring reliable income over a designated period of time.

Decumulation is complex, but managing it doesn’t have to be. Even advisors without significant planning experience or deep technological expertise can efficiently and effectively execute portfolios that provide a predictable set of drawdowns based on investor income needs and timelines.

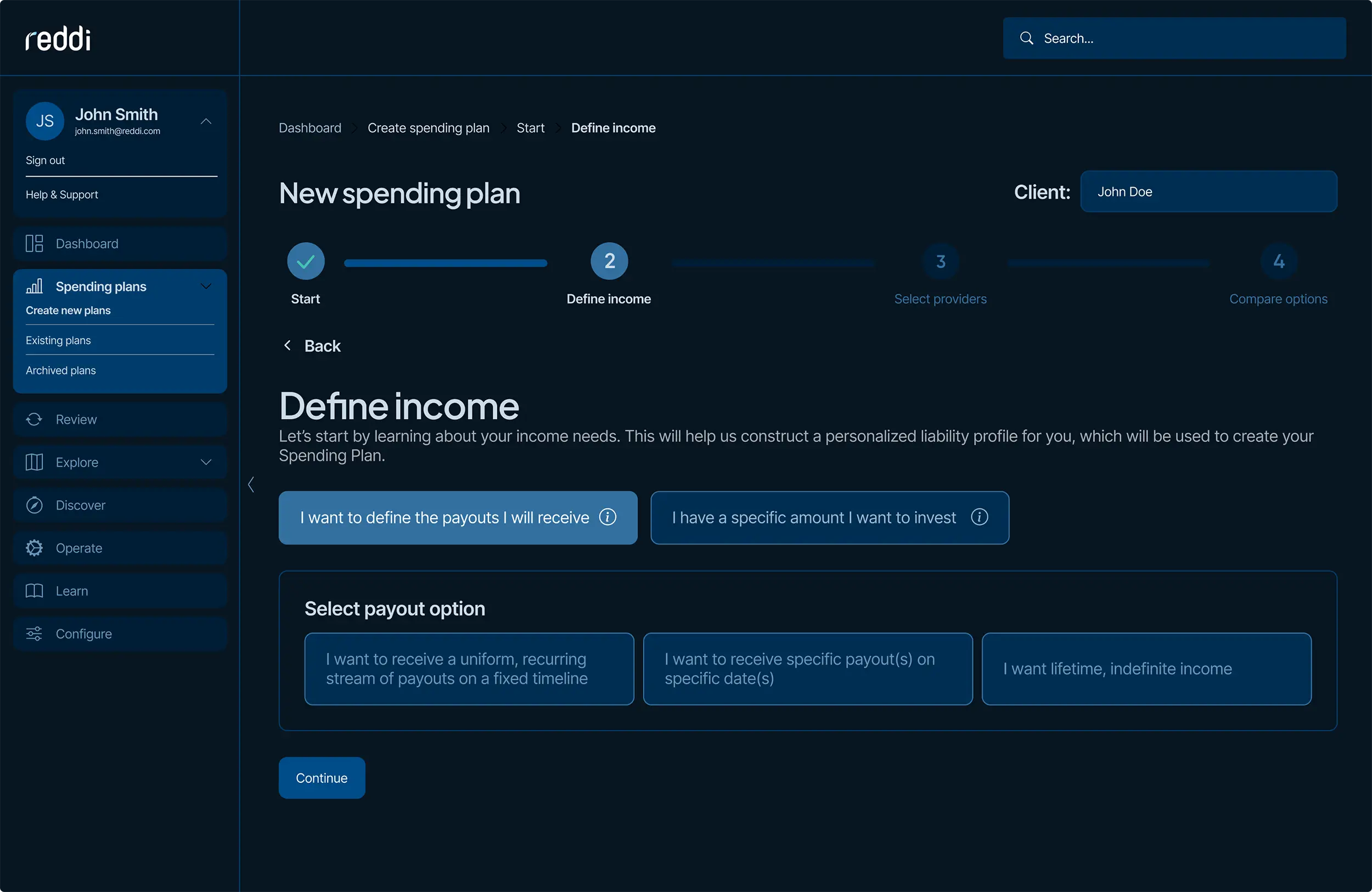

reddi guides advisors through a simple, step-by-step workflow to develop a spending plan for clients desiring a reliable stream of income over a prescribed period of time.

- Define Income Needs

Follow a sequential process to capture client-specific income needs and desired payout schedule. - Select your ETF Provider

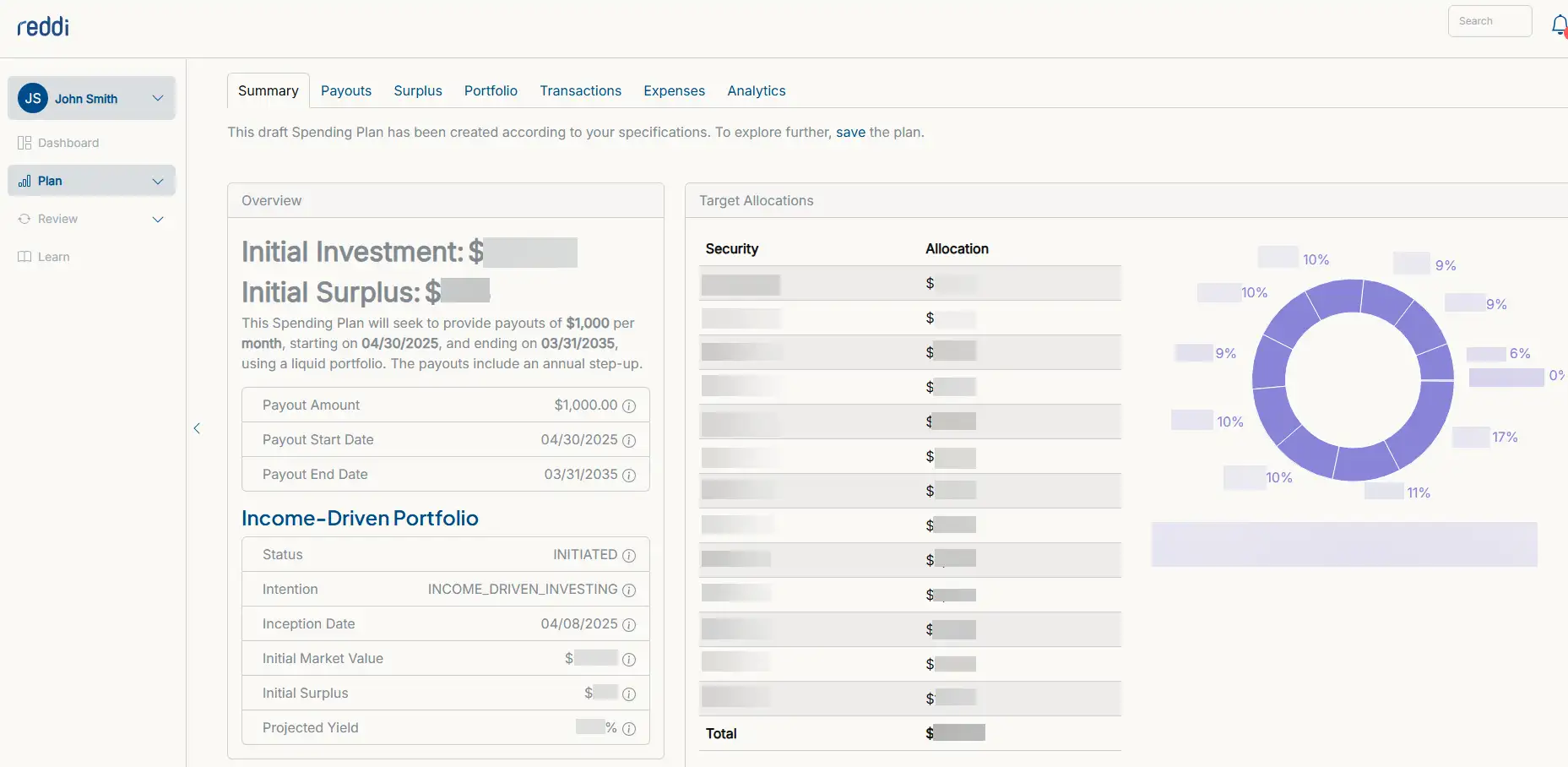

Choose from low-risk ETF investment options by cash flow, payout streams, and portfolio allocations. - Design the Portfolio + Distributions

Create an immunized portfolio that provides a competitive return consistent with duration.

Income Certainty That’s Easy to Explain

reddi simplifies income planning with an intuitive, user-friendly visual interface.

reddi presents a compelling alternative to traditional decumulation solutions like annuities with a value proposition that’s easy for you to share with your clients: Predictable, risk-mitigated income with full liquidity and control.

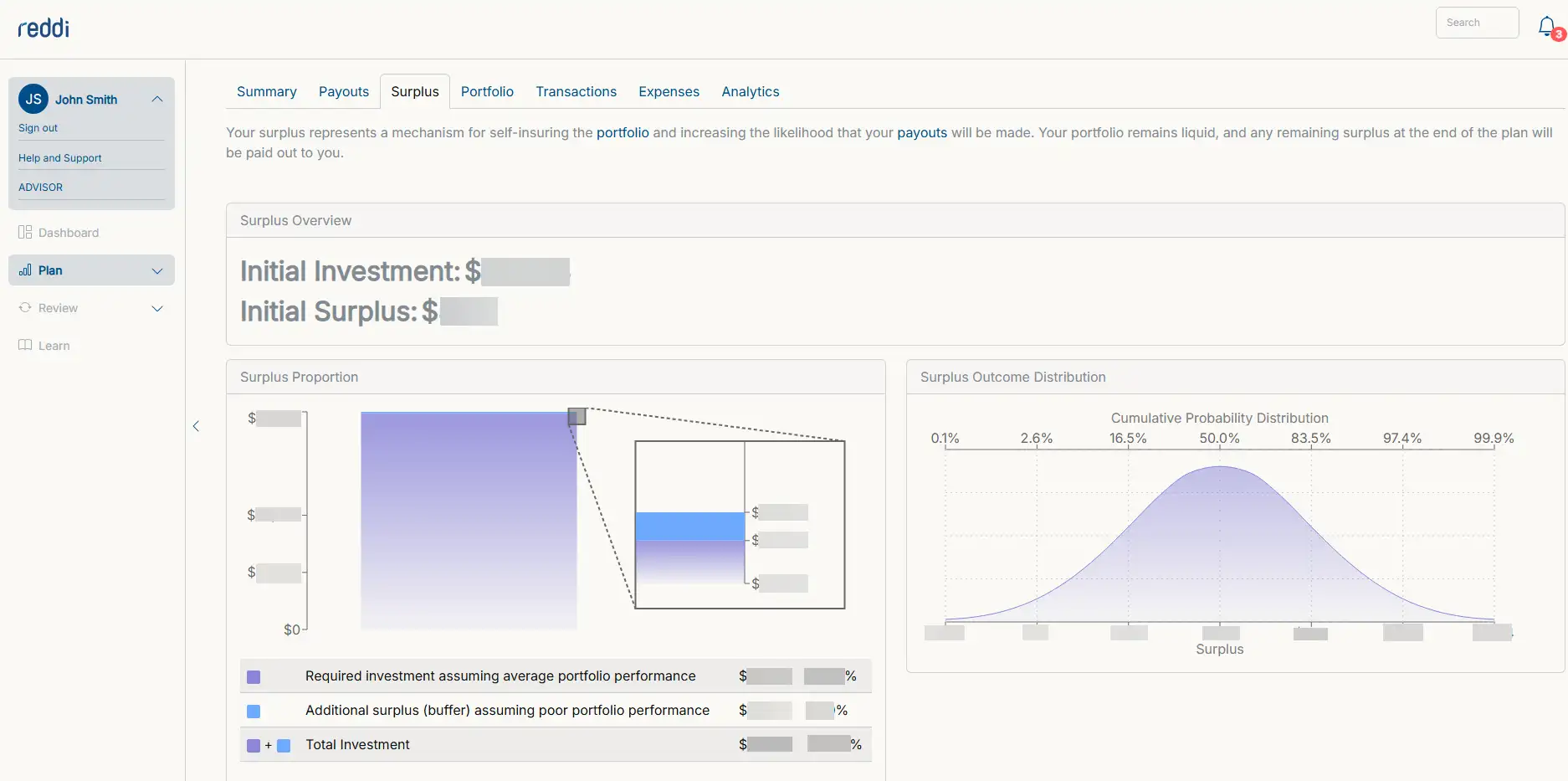

Innovative Self-Insuring Surplus Model

An investment surplus acts as a safety buffer against volatility and credit risk to maintain income certainty. The surplus amount is automatically calculated and added to the investment total based on income needs and timeline, and any remaining surplus is paid back at the end of the spending plan.

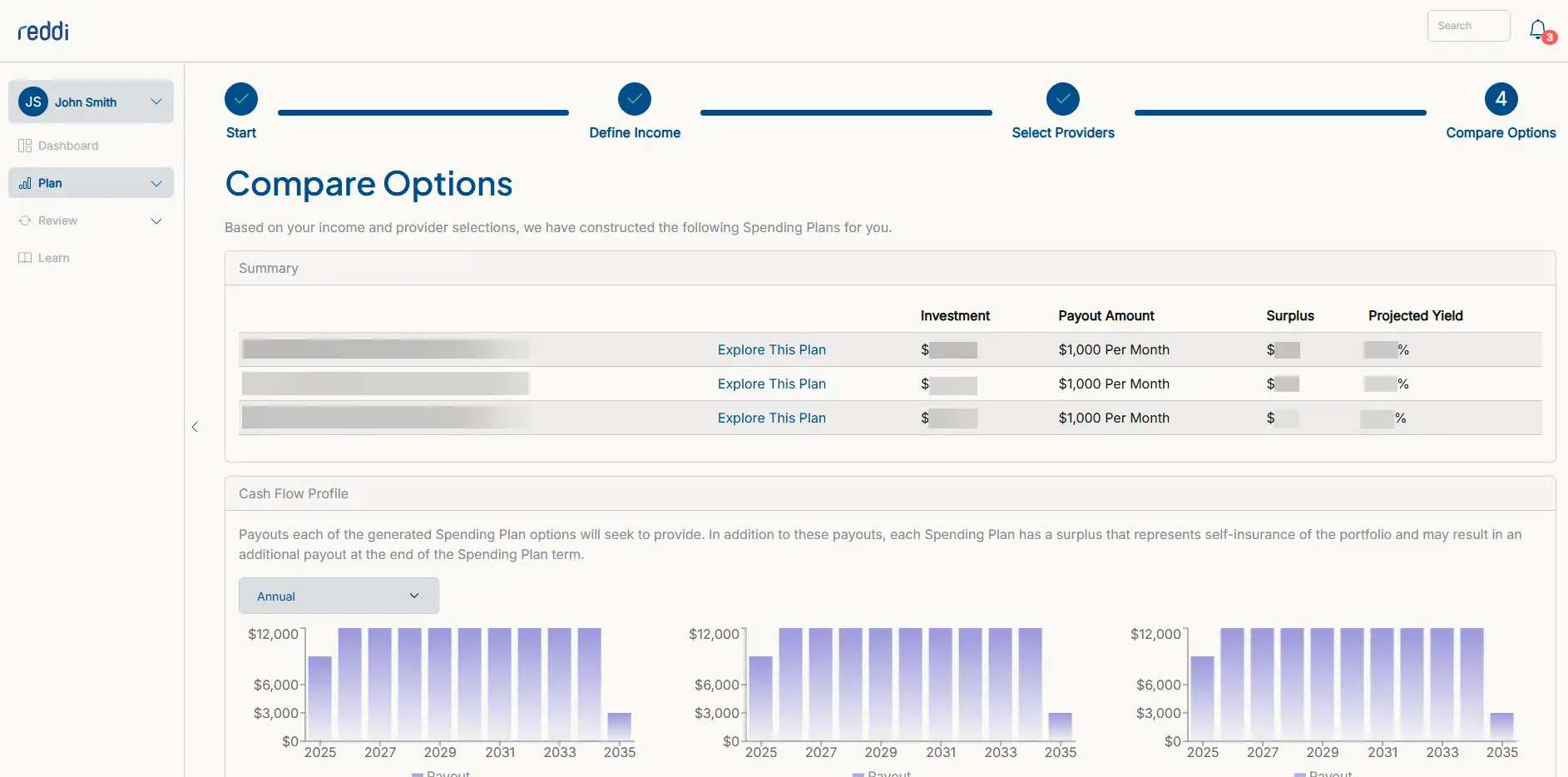

Comprehensive Visual Comparison Tools

Visual representations of scheduled payouts alongside portfolio cash flows strengthen understanding and confidence to help clients understand how their predictable income is generated. Simplified portfolio views and metrics offer deeper analytics for advisor due diligence.

Customizable User Experience Capabilities

A flexible interface and navigation options allow you to set individual preferences, and you can choose from a list of low-risk ETF providers. reddi can also be white labeled to your firm’s specifications to provide a cohesive brand experience.

Effortless Decumulation Management Backed by Decades of Institutional Expertise

Powered by a patented technology platform designed expressly to simplify income planning

For decades, our affiliate NISA Investment Advisors has delivered sophisticated defined benefit and fixed income solutions for some of the largest asset owners in the world. Through reddi, NISA Connect has leveraged this experience to build a desperately needed tool for advisors serving clients struggling with decumulation.

Through reddi, NISA translates deep institutional knowledge into a desperately needed tool for advisors serving clients struggling to understand how to pay themselves in retirement.

The patented, income-driven investing technology adapts Liability-Driven Investing (LDI) principles by efficiently diversifying credit risk to create self-insured portfolios that precisely match each client’s income needs.