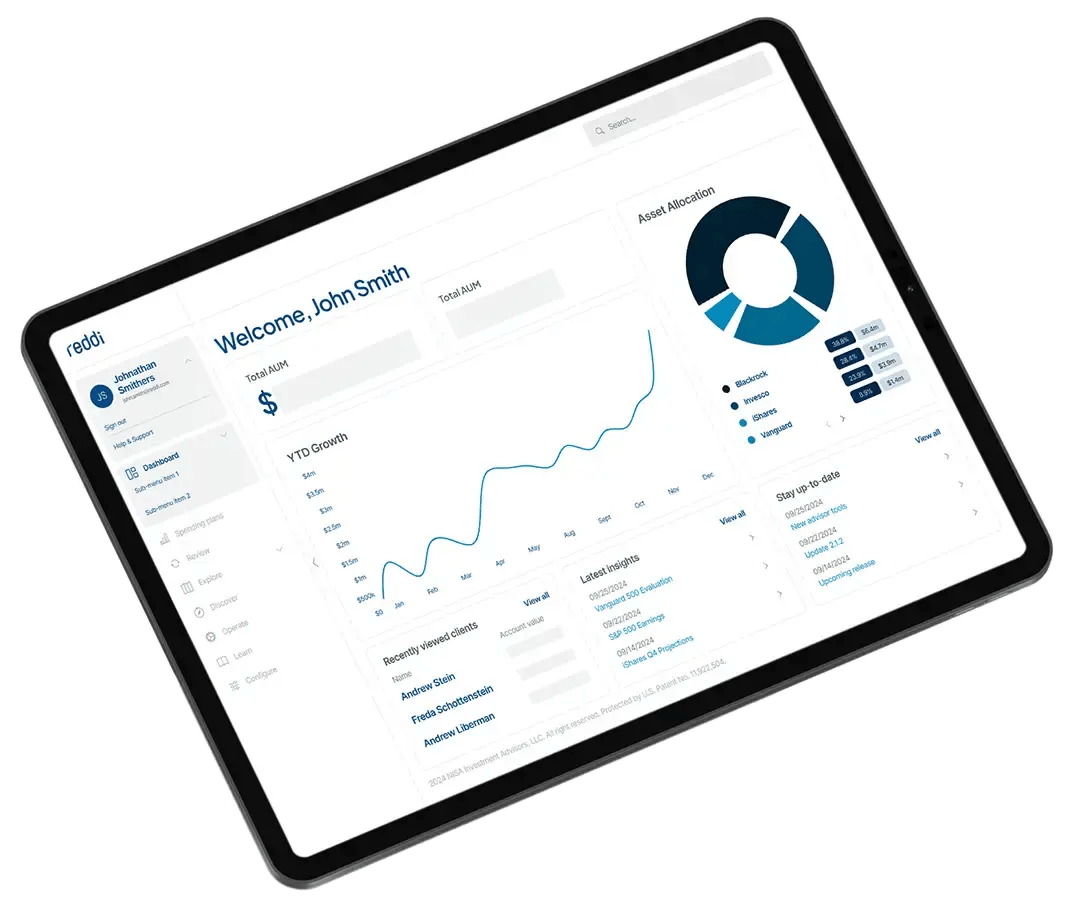

Meet reddi

Learn what’s driving the innovative new platform developed and powered by NISA Connect (an affiliate of NISA Investment Advisors). reddi is a breakthrough in decumulation management, offering pension-level predictability for advisors and investors seeking improved control, liquidity, and flexibility.

Managing Predictable Distributions

Typically, investment portfolios are built with a return-seeking objective based on their underlying assets. However, when future distributions or spending needs are considered as mandatory, managing the portfolio should be structured to ensure these distributions occur with near certainty, similar to how Defined Benefit (DB) plans manage pension liabilities. This approach, known as Liability-Driven Investing (LDI), is used by Defined Benefit plan sponsors to hedge corporate pension obligations.

Democratizing Institutional LDI Strategies

Leveraging NISA’s Investment Advisors deep institutional expertise, reddi empowers advisors and their clients to design drawdown plans with the effective certainty of an income annuity. With just a few advisor inputs, reddi uses a patented, income-driven investing strategy that efficiently diversifies credit risk to create self-insured portfolios precisely aligned with each client’s income needs.

Bringing Best-in-Class Income Solutions to Retail Investors

Pension-level predictability backed by decades of institutional knowledge

For decades, our affiliate NISA Investment Advisors has delivered sophisticated defined benefit and fixed income solutions for millions of Americans. Through reddi, NISA Connect has leveraged this experience to build a desperately needed tool for advisors serving clients struggling with decumulation.

Meet the Team

Get to know the team helping Americans spend confidently in retirement.

William Marshall

CEO, NISA Connect | reddi

Bill is co-founder of reddi and innovator behind Income-DrivenTM Investing. He serves as CEO of NISA Connect, a technology affiliate of NISA Investment Advisors, where he was Head of DC and Wealth Solutions. He was previously a managing director with AllianceBernstein Defined Contribution responsible for launching and advancing their multi-insurer Lifetime Income Strategy to serve as an individualized lifetime income delivery platform. At Allstate Financial he created the market’s first Target Date Fund series plus Contingent Deferred Annuity (lifetime income) sold as a “G Share” or guaranteed share class. Prior experience includes innovations in capital markets at JPMorgan Securities as a trader developing new asset-backed securities and financing strategies. Bill is also a former active duty military officer stationed primarily in Europe. He holds an MBA from the University of Chicago Booth School of Business and a BS in Economics from the United States Military Academy at West Point.

Nicholas Cangiani, CAIA

CTO, NISA Connect | reddi

Nick is co-founder of reddi and CTO of NISA Connect, a technology affiliate of NISA Investment Advisors, where he was Head of Technology for DC and Wealth Solutions. He leads technical development and operational management of the reddi platform bringing over two decades of experience to the intersection of finance and technology. Previously at NISA Investment Advisors, Nick served as Associate Chief Technology Officer and Chief Software Architect, where he led engineering teams and architected systems to support industry-leading liability-driven investment strategies. Prior to NISA Investment Advisors, Nick was a Vice President of Defined Contribution Technology at AllianceBernstein, and has held technical roles at A.M. Best Company and the New York City Police Department. He holds an MBA from New York University’s Stern School of Business and a BS in Computer Science from the College of New Jersey.

Get reddi for a Powerful Partnership

Make decumulation management your unique competitive advantage.

With more investors retiring every day, technology platforms that empower financial advisors to turn decumulation into a point of competitive differentiation rather than rapid and unavoidable asset loss will win.

Enable modern drawdown

strategies for fiduciary advisors

Advisors serving in a fiduciary capacity must solve the decumulation challenge to truly act in the best interests of their clients. Be the platform that helps them do that without depleting their AUM.

Emerge as a beacon of

planning innovation

As the first-of-its-kind investment income solution, reddi empowers advisory platforms and the advisors who use them to capture the staggering amount of sidelined retiree assets waiting to be transitioned to income reliably.

Retain more platform

assets for longer

reddi empowers technology providers and the advisors they serve to retain control over and management of investor assets that are drawn down slowly over time, rather than all at once.